inheritance tax waiver indiana

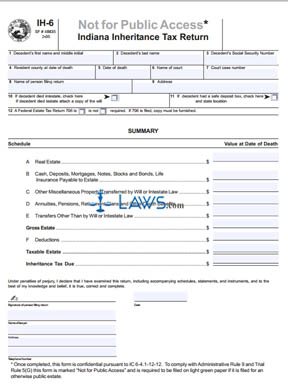

The taxes are calculated based on the taxable. Indiana Affidavit Forms - Indiana Inheritance Tax Waiver Form.

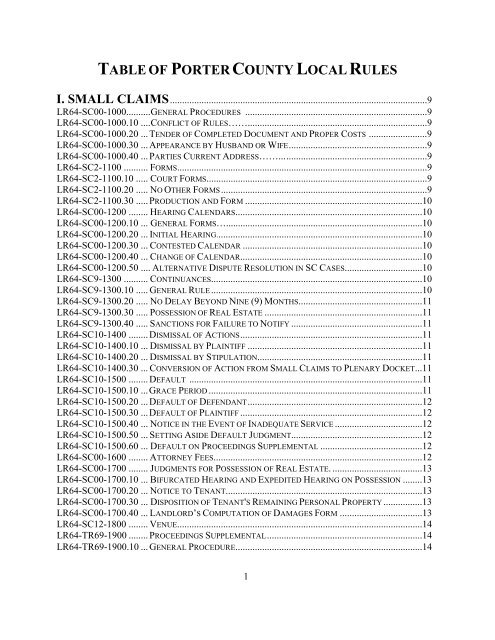

Indiana Court Records Staterecords Org

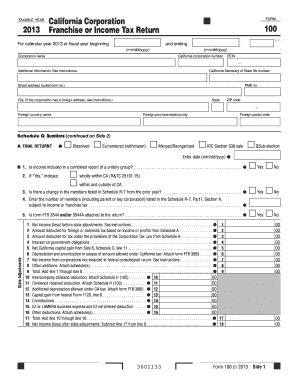

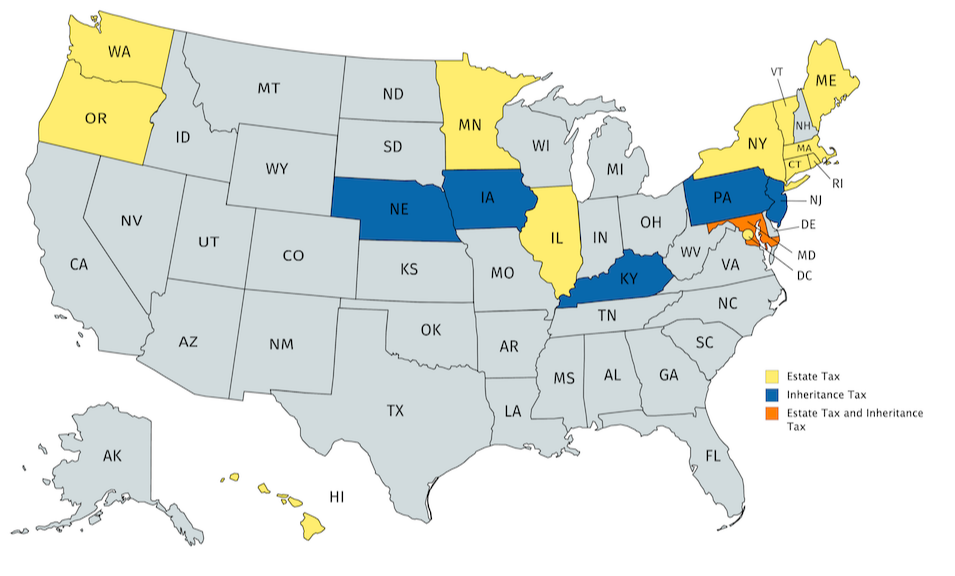

Estate taxes may still need to be paid in those jurisdictions depending on the applicable state.

. Inheritance Tax Information Consents to Transfer Individuals Dying Before January 1 2013 Those seeking to transfer decedents financial assets will need to complete and submit a. Indiana tax return 2021. Like with the indiana tax waiver form is being filed may be paid attorney listings on who has discretion in receiving the place to be.

Estate tax is the amount thats taken out of someones estate upon their death while inheritance tax is what the beneficiary the person who inherited the wealth must. Indiana inheritance tax waiver form. Inheritance tax waiver form ohio.

The Inheritance Tax Return must be filed. There is no inheritance tax in Indiana either. Find the right affiliate you need that is indiana state specific.

Indiana Inheritance and Gift Tax. Please read carefully the general instructions before preparing. Find the right affiliate you need that is indiana state specific.

The taxpayer would file a waiver of notice and there would be no appraisal by the county anyway. Indiana gift tax 2021. However other states inheritance laws may apply to you if someone living in a state with an.

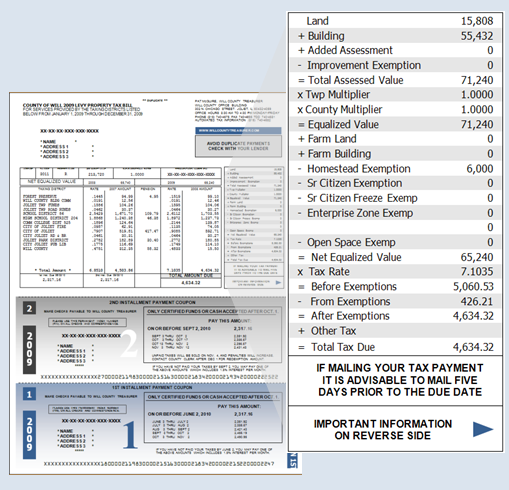

You do not need to pay inheritance tax if you received. Box 71 Indianapolis IN 46206-0071. Federal estate taxes state estate taxes and state inheritance taxes generally are due about nine months after the date of death.

In order to make sure. So the change was made to avoid unnecessary paperwork 2002. The statements herein are true and correct to the best of such persons.

Indiana inheritance tax waiver form. An affidavit is used in Indiana where a person states facts are true to the best of there knowledge. You do not need to pay inheritance tax if you received.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

Its usually issued by a state tax authority. Her and is not subject to Indiana inheritance or estate tax and further says under the penalties for perjury that. Do not file Form IH-6 with an Indiana court having probate.

Indiana repealed the inheritance tax in 2013. Indiana tax waiver form is for others to avoid taxes. Prescribed by the Indiana Department of State Revenue InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note.

Inheritance tax waiver form.

Covid 19 Impact On Indiana Property Tax Exemption Eligibility

Indiana Estate Tax Everything You Need To Know Smartasset

Free Real Estate Lien Release Forms Pdf Eforms

.png)

Iowa Inheritance Tax Law Explained

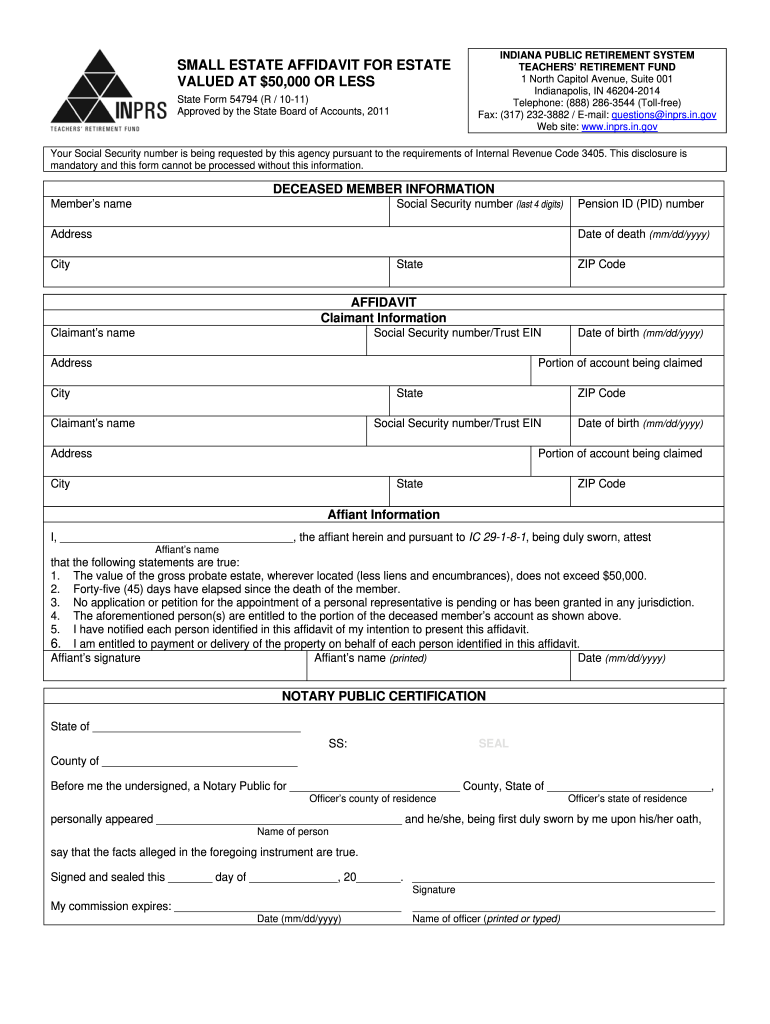

Indiana State Form 54794 Fill Out Sign Online Dochub

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

The Franklin Evening Star From Franklin Indiana On June 20 1956 Page 7

Brown County Democrat From Nashville Indiana On March 1 1951 Page 1

Indiana State Form 54794 Fill Out Sign Online Dochub

Fort Wayne Indiana Tax Preparation Planning Services Keiffer Fries Tax Business Solutions Inc

State Estate And Inheritance Tax Treatment Of 529 Plans

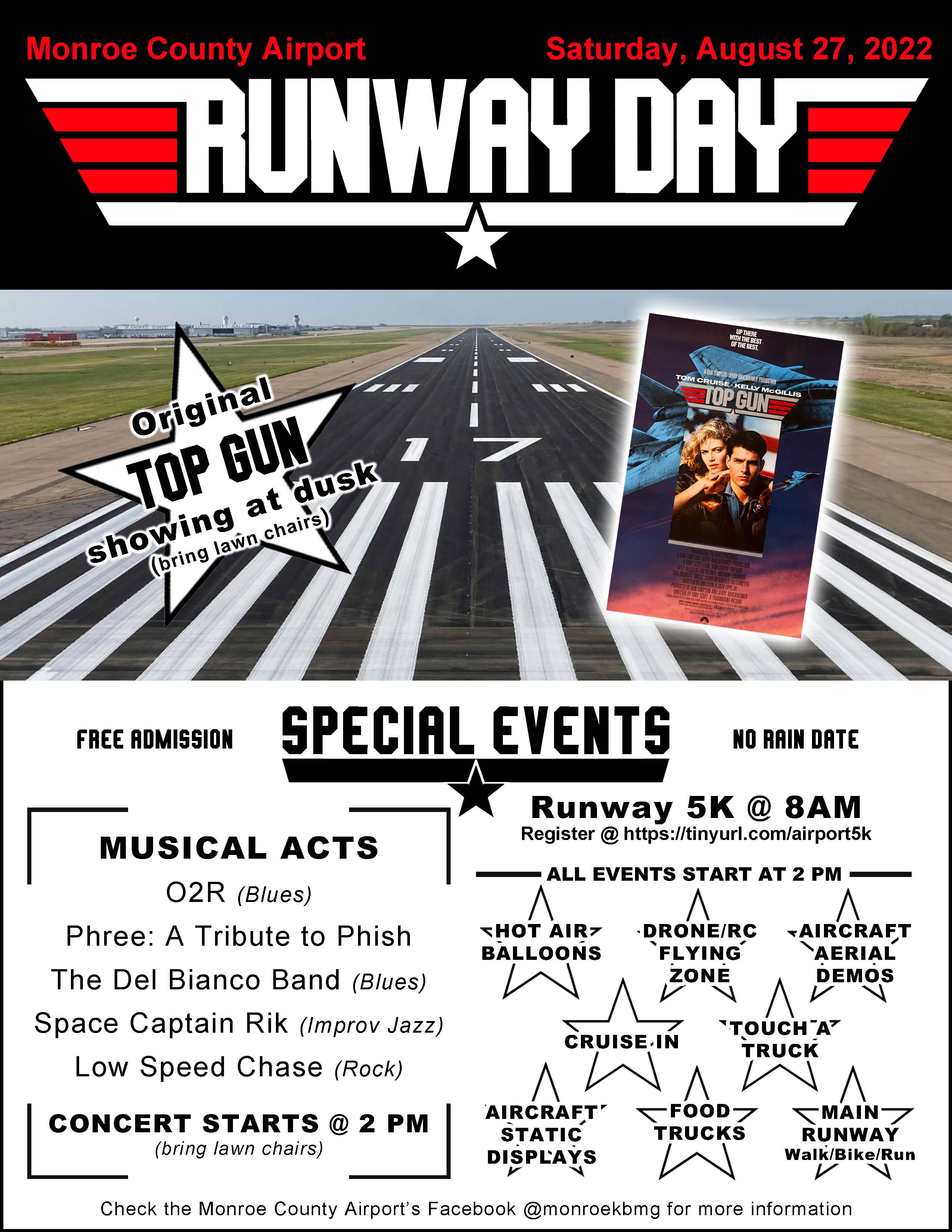

County Home Pageairportassessorauditorbuilding Departmentboard Of Commissionersboards Commissions Committeescircuit Courtclerk Of Courtcommunity Correctionscoroner S Officecounty Councilemergency Managementhealth Departmenthuman Resourceslegalparks

Estate Tax Waiver Notice Et 99 Pdf Fpdf Docx New York

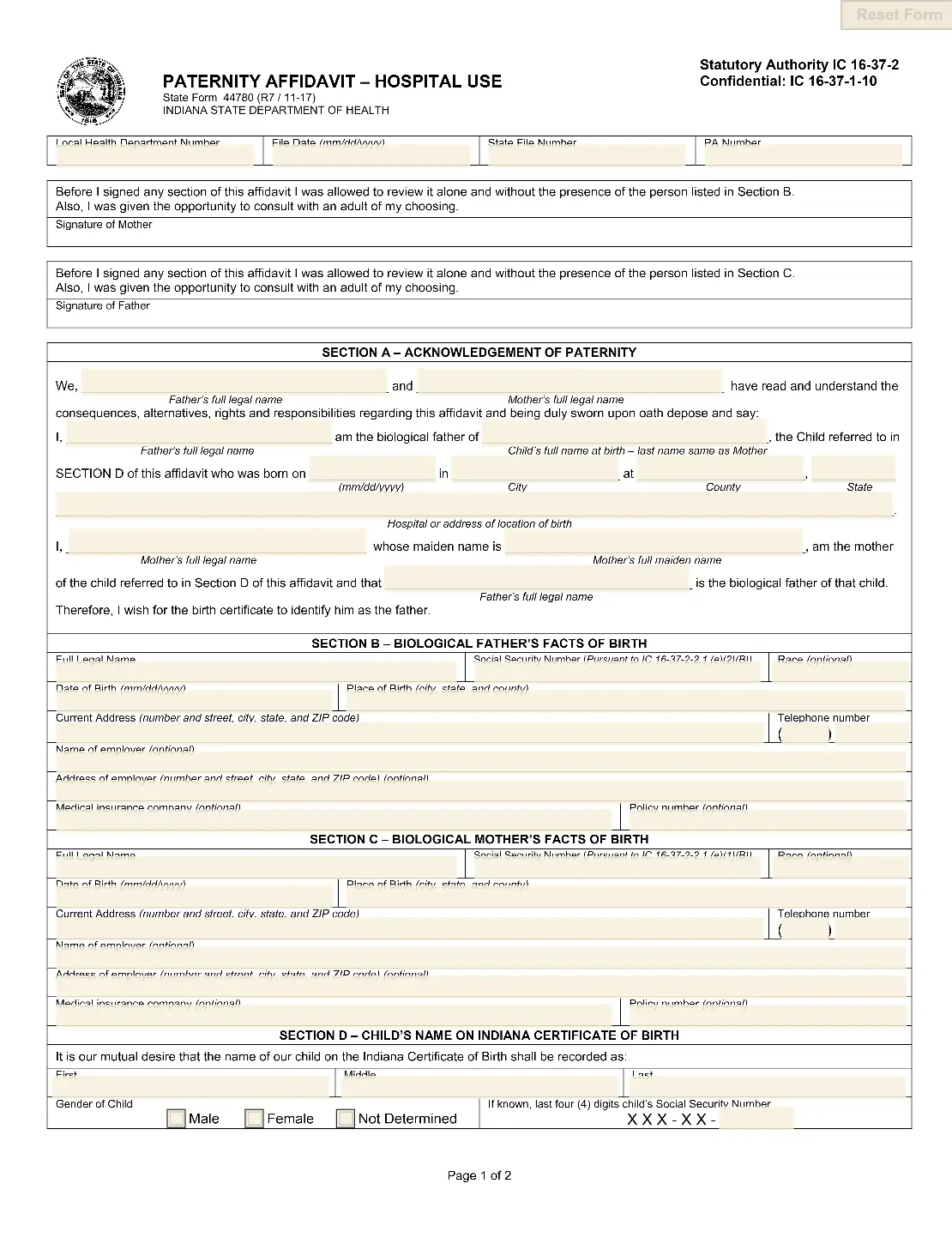

Indiana Paternity Affidavit Template In Form 44780

How Indiana Probate Law Works Probate Advance

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com